See All Insights

See All Insights

Table Of Contents

As corporate sustainability ambitions increase and investors demand increased accountability, companies must shift the traditional responsibility and activities of the CFO and broader finance function.

Since 2005, companies disclosing to CDP have increased carbon reduction targets threefold, from an average reduction of two percent per year to six percent per year today. Timelines to achieve these goals have also narrowed, instead of setting goals 25 years in the future, companies now state an average duration of just eight years to meet their goals. The ambition didn’t stop there. Companies are now looking beyond their own operations to include the entire value chain, as we’ve seen in recent announcements from companies like Apple, BMW, Microsoft, and UPS.

This shift has persisted even through the COVID-19 pandemic, with companies and their stakeholders doubling down on sustainable action. Six months after Larry Fink’s cautionary, climate-centered letter to CEOs in January of 2020, BlackRock took decisive voting action against 53 companies over climate concerns and placed 191 companies “on watch” for insufficient progress on climate considerations.

Yet even with the increased ambition and accountability, few companies are on track. The question is, why? When reviewing our work with Fortune 500 companies across the globe, we see a common hurdle: Many leaders have bold targets, but when it comes time to implement, they struggle to establish the right capital allocation models and governance structures needed to match their strategic intent.

The finance department lies squarely at the heart of this challenge. As goals become more ambitious and investors demand increasing accountability, there must be a shift in the traditional responsibility and activities of the Chief Financial Officer and the broader finance function.

In this article, we’ll first examine the traditional structures that limit finance’s role in sustainability transformation. Second, we’ll focus on how organizations can evolve their financial activities according to the proposed Three Stages of Sustainability Integration Framework.

Stay current on our latest insights. Subscribe for updates →

To unlock progress to sustainability transformation at the necessary speed and scale of today’s ambitious targets, the finance function needs to share accountability for achieving these goals. Drawing on our experience working with global multi-national organizations, we see four main barriers, spanning strategic, organizational, and cultural dimensions, that slow the progress of sustainability transformation in the finance function.

Historically, sustainability issues were tackled within the CSO function, receiving only occasional attention from financial leadership. This reality is quickly evolving. In Davos this year, 3,000 global leaders convened to discuss their roles as stakeholders in a sustainable world. For the first time, climate change contributed to all five of the top global risks in The World Economic Forum’s Global Risk Report. But for many companies, sustainability still is not considered a core competitiveness issue, and fails to receive the financial and human capital necessary to tackle a challenge of its size.

Even with improved access to environmental data, companies often lack adequate mechanisms to value the benefits of managing environmental sustainability. This is critical to managing exposure to energy price volatility, water scarcity risks, water and waste regulations, and more generally environmental footprints in their supply chains. A long-term lens, captured in adequate pricing mechanisms, is essential to making the right decisions.

Sustainability teams are often brought into project planning too late to influence project design and cannot make an effective case to financial decision makers. Conversely, the benefits of sustainability strategies are not readily captured in the financial criteria typically used, which leads finance teams to overlook meaningful short- and long-term financial benefits of sustainability strategies, such as enhanced reputation and reduced climate risk. Without having shared, quantifiable success metrics, such as reduced carbon emissions, teams lack the incentive to innovate and collaborate across departments.

For years, corporations have cited lack of available capital as the primary barrier that slows or halts the implementation of critical sustainability projects. As a result, a myriad of service models, debt instruments, and new forms of capital have emerged to lessen the financial burden, share risks, shift the needs for upfront capital, and even reconsider the importance of asset ownership.

While there’s broad awareness of sustainable finance measures like sustainability-linked loans or internal carbon pricing, knowing when and how best to implement them remains a challenge.

By developing a strong understanding of the benefits and drawbacks of each potential lever, finance leaders have an arsenal of tools at the ready to minimize the costs and risks associated with sustainability projects.

When these measures are successfully sequenced across the portfolio of necessary investments, organizations can successfully capture both the environmental and financial benefits at stake.

The rise in increasingly ambitious sustainability goals clearly demonstrates that corporate leaders see value in climate action—both to address stakeholder demands and to mitigate near- and long-term risks. They see opportunity in implementing new technologies and business models, particularly if they seize opportunities early.

The finance team plays a critical role in realizing this value, but to do so, they must be fully integrated into—and feel a sense of accountability for—the company’s sustainability transformation. In our work with global organizations, we’ve commonly seen three stages of evolution in this integration process: opportunistic, thematic, and holistic. Progression through these integration stages is essential for companies to achieve their sustainability goals on the necessary timeline and unlock the direct and indirect benefits.

To place themselves along this spectrum, finance leaders should start by considering the following questions:

Use the framework below to assess the current maturity of your company’s finance function and set goals to track progress to ensure that the finance team is keeping pace with the company’s overall sustainability objectives.

To provide additional context for the Stages of Integration, we’ve leveraged insights from our decades of experience working with large multi-national corporations to offer the following scenarios.

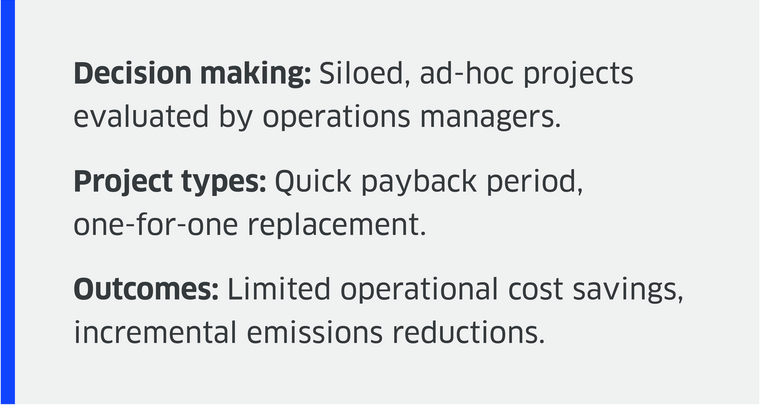

At Company A, the leadership team understands the high-level benefits of sustainability programs and releases a general environmental, social, and governance (ESG) policy on an annual basis, overseen by a newly hired corporate sustainability director. Day-to-day operations and broader corporate strategy continue to be driven by short-term profitability goals focused on efficiency. Company A has not committed to any measurable sustainability targets. Instead, sustainability initiatives are evaluated on an ad-hoc basis, assuming they provide clear cost savings.

In support of its efforts to minimize costs and long-term liabilities, the finance group has set a narrow constraint for its operators: any proposed project should pay itself back in less than two years, regardless of whatever other values it delivers. As projects are presented, the finance team helps operators verify project costs to determine whether Company A has budget available.

One of its facilities managers recommends that they replace the building's incandescent and halogen bulbs with LEDs. The costs are relatively low and the whole replacement can be done with minimal business disruption over a weekend. The bulbs each cost $10 to replace but generate $20/yr/bulb in savings, paying for themselves in just six months. The finance organization approves the change and funds the project using cash-on-hand or tapping into its working capital facilities.

Though Company A sees a 70% reduction in energy consumed by lighting, lighting is a relatively small proportion of its overall operating expenses and carbon emissions. In total, the projects that meet the thresholds set by finance make a positive, yet minimal, overall impact.

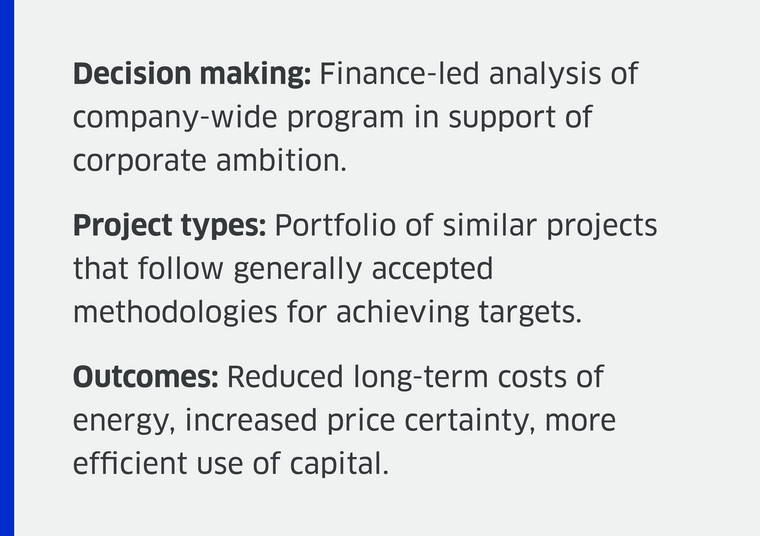

Company B has communicated sustainability progress for the past five years. This year, Company B has introduced a specific, quantifiable goal: sourcing 50% of its global energy consumption from renewable energy sources by 2025.

Company B recognizes the significant financing effort required to execute this multi-year initiative and has involved the CFO in early-stage conversations as they explore on- and off-site renewable generation options with developers. One of the CFO’s first priorities is to evaluate the suitability of power purchase agreements (PPAs) to finance the up-front capital costs for the expected portfolio of projects.

Company B has not executed a PPA before, so there are a number of dimensions for the CFO to consider, including:

Now that the company has committed to long-term sustainability goals, the CFO is motivated to consider sustainable finance options that had not been feasible when the company’s sustainability goals were more opportunistic and less programmatic. In particular, the CFO evaluates use-of-proceeds instruments like green loans and green bonds. These options present an attractive way to raise capital now that the company is contributing to the creation of new sources of green energy.

The CFO found the process leading up to the execution of the company’s first PPA to be quite time-consuming. Moreover, navigating the complexities of this unfamiliar contractual arrangement was often frustrating. Still, that initial investment in analysis proved worthwhile as the company leverages that hard-earned experience to sign additional PPAs.

Moreover, the company’s expanded decarbonization goals create a rationale for the CFO to seriously investigate sustainable finance options for the first time, expanding the company’s bank and investor network, and laying the foundation to finance a broader range of decarbonization measures in the future.

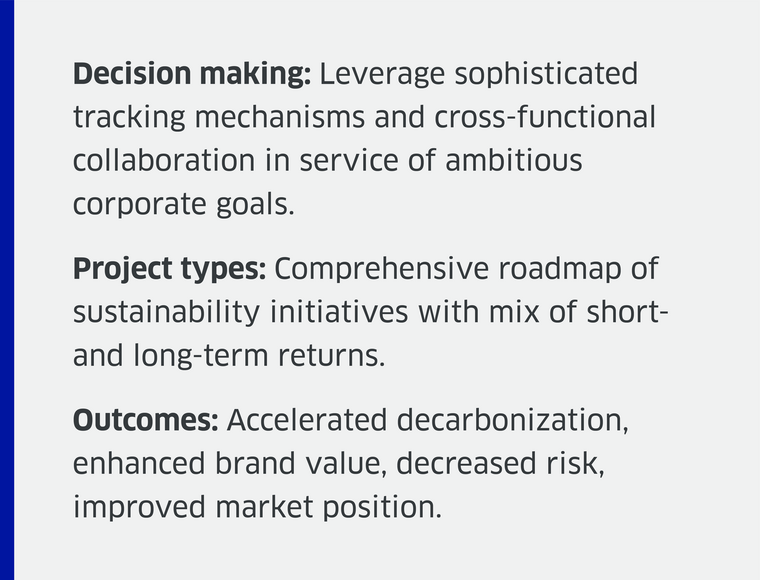

Company C has developed a comprehensive understanding of the importance of sustainability to the success of their organization and sees sustainability as embedded in the core of their business. They have set science-based decarbonization targets, data-driven goals in support of material social issues, a strong governance structure, and designed a roadmap to execute a strategic portfolio of projects. The CFO’s performance, like all members of the executive team, is measured against the success of these company-wide initiatives and plays a proactive role in driving progress.

The CFO has shifted expectations, processes, and tools to best align her team’s performance to corporate sustainability outcomes. Finance leads the conversation for sustainability as a source of value creation:

Adopt alternative asset ownership strategies: The finance team’s role extends beyond interfacing with internal functions to structure engagements with third parties to manage non-core assets with significant decarbonization potential. The finance team has developed a portfolio of partnership agreements structured to minimize risks associated with technology, performance, and maintenance needs.

Introduce internal carbon valuation measures: The finance function calculates and institutes an internal carbon price and budget. With increased transparency, internal teams independently look for emissions reduction opportunities and new creative solutions emerge, such as workspace redesign, optimized shipping schedules, and carbon credit trading. The tool is also leveraged to help quantify and mitigate future risks and opportunities associated with changes in climate policy, thereby protecting the downsides that might be created in such scenarios.

Overall, Company C’s finance team leverages its broad understanding of the company to champion sustainability as a means to create incremental value and build sophisticated mechanisms across the organization to ensure that value is realized. In a two-way proposition, it can achieve its more ambitious goals with greater ease and, conversely, also ensures it captures the full commercial and risk mitigation benefits from these programs.

We are entering a new chapter of corporate sustainability. As investors hold companies increasingly accountable, business leaders can no longer rest on the laurels of their ambitious targets but must now deliver on the future they’ve promised.

With rising accountability comes increasing guidance. New principles are emerging as a result of the United Nations CFO Taskforce, which will provide new guidance for finance leaders to adopt changes that drive meaningful progress toward sustainable development.

CFOs should initiate a dialogue with their peers and sustainability experts to share ideas to best adapt these principles to meet the needs of their operations.

The world is changing quickly. As companies navigate this new normal together, it will be those that successfully structure their investments and prepare for risks that unlock the true value at stake.

Don’t miss the latest content from our sustainability consultants. Subscribe for our Sustainability Transformation updates.

Let's work together to integrate sustainability across your organization.